With technical indicators aligning, market watchers anticipate a possible breakout that could push XRP toward significant milestones.

Monthly Chart: Green Bent Fork Offers Optimism

On XRP’s monthly chart, the partial body of the current candle hovers above a key trendline dubbed the “Green Bent Fork,” signaling sustained bullish momentum. According to analyst EGRAG CRYPTO, if XRP holds this position through the end of January, it could validate expectations for an upward surge.

Ripple’s XRP technical analysis suggests explosive price movements ahead. Source: EGRAG CRYPTO via X

EGRAG’s broader outlook paints an ambitious picture, with potential price targets as high as $30 and $50, corresponding to the Blue Fork, and even $60 at the White Fork. These long-term projections hinge on XRP maintaining its momentum and securing critical levels.

Daily Chart: Pennant Patterns and Breakout Potential

On the daily chart, XRP forms a bullish pennant, a pattern typically associated with a continuation of upward trends. This setup suggests a breakout could occur by early February 2025. Analysts estimate that such a breakout may propel XRP to the $5.1–$5.4 range, offering an optimistic outlook for both conservative and aggressive traders.

A bullish breakout above $3 could push the XRP price above $8 and beyond. Source: EGRAG CRYPTO via X

The pennant structure highlights a contracting price action, which traders are monitoring closely. “This narrowing signals a decision point,” notes one market expert, emphasizing the importance of volume build-up to confirm the breakout.

Elliott Wave Analysis: Long-Term Targets

CoinsKid, another prominent crypto analyst, leverages Elliott Wave Theory to outline XRP’s potential trajectory. According to CoinsKid, Wave 3’s peak is projected around $4, while Wave 5 could extend above $8.31. These targets reflect confidence in XRP’s ability to navigate market challenges and capitalize on bullish setups.

According to XRP’s Elliott Wave analysis, the fifth wave targets as high as $8.31. Source: CoinsKid via X

However, CoinsKid also warns of a potential bearish phase later in the year, which could temper near-term gains. “Key accomplishments in price levels will remain pivotal, even if broader market conditions shift,” CoinsKid adds.

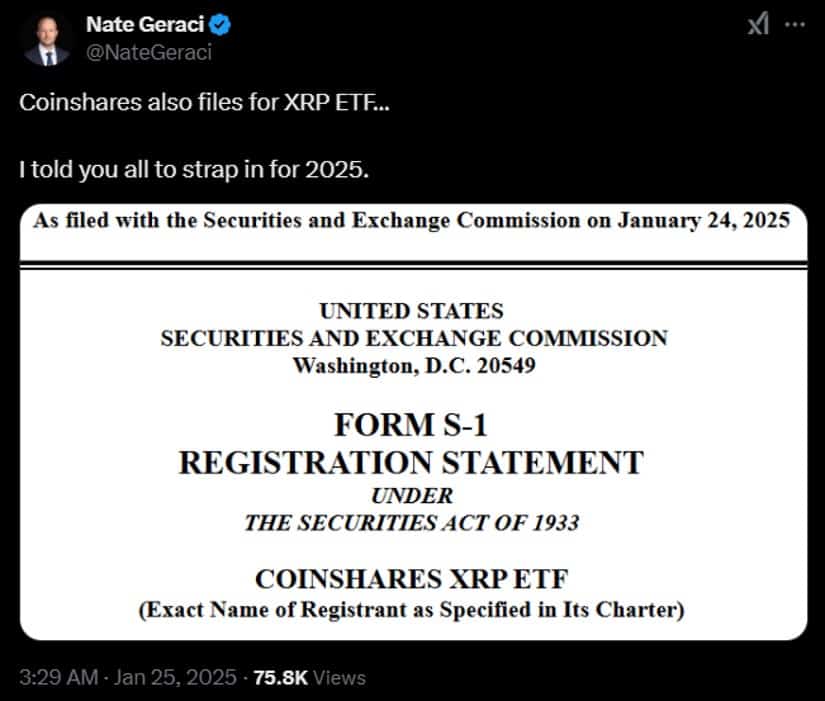

Market Sentiment and XRP ETF Progress

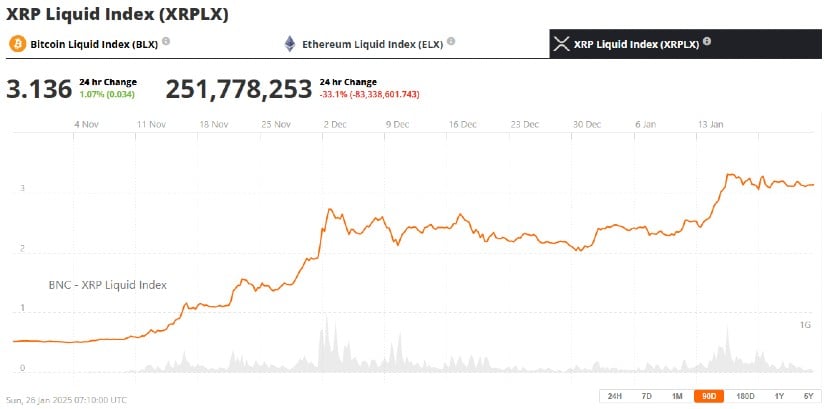

While XRP’s charts indicate significant upside potential, broader market conditions remain a factor. Currently trading around $3.10, the token faces challenges in achieving immediate exponential growth. Analysts point out that a 222% rally to $10 would require catalysts such as strong institutional support, ETF approvals, or major shifts in market dynamics.

Coinshares files for XRP ETF. Source: Nate Geraci via X

The influence of macroeconomic factors and regulatory developments also looms large. For instance, Ripple’s increasing adoption and high-profile partnerships continue to bolster its long-term outlook, even as short-term volatility persists.

A Measured Path Forward

At press time, XRP was trading at $3.13, up 1.07% in the last 24 hours.

Source: XRP Liquid Index (XRPLX) viaBrave New Coin

XRP’s technical and fundamental indicators suggest a promising future, but cautious optimism remains the prevailing sentiment. While predictions of $8 and beyond are grounded in robust analysis, achieving these milestones will depend on a mix of bullish catalysts, market confidence, and sustained momentum.

The XRP news that is likely to have the biggest impact in the short term, is confirmation that American based crypto assets such as Ripple’s XRP will be exempt from capital gains tax. This has been hinted at by Eric Trump and is likely a key part of President Trump’s crypto platform. As is the much-discussed digital assets stockpile. This is also likely to include XRP.

As traders and investors keep an eye on key levels, the coming weeks and months will likely prove critical in determining whether XRP’s bullish forecasts materialize.