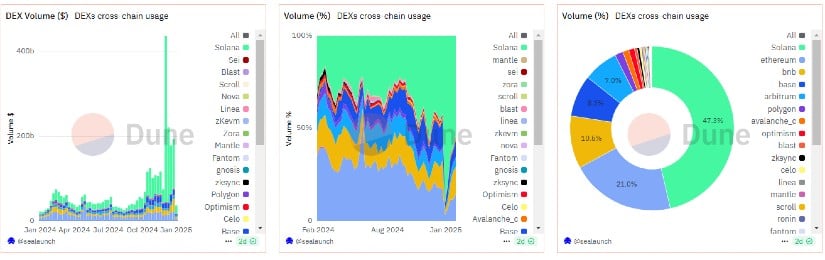

According to a January 2025 report by crypto exchange OKX, Solana has captured roughly 50% of the total DEX volume in recent weeks, with some periods surpassing Ethereum’s trading activity.

The rise has been so notable that analysts have likened it to Solana “drinking the Ethereum milkshake,” taking market share from Ethereum and solidifying its position in the decentralized finance (DeFi) ecosystem.

Memecoins and Rapid Growth Fuel the Surge

The major factor behind Solana’s impressive DEX performance is the launch of the memecoin platform, Pump.fun. This launchpad has significantly driven trading activity, even at times surpassing Ethereum’s DEX volume. OKX’s report highlights that Solana briefly reached an astounding 89.7% market share in DEX activity during the last week of December 2024. For five consecutive weeks, its share has remained above 50%, a clear indication of the network’s growing influence.

Solana (green) leads the DEX market, surpassing all other chains in trading volume. Source: Dune

Solana’s rise is attributed to its high transaction speeds, minimal fees, and developer-centric tools, which have made it especially appealing to retail traders. Jupiter, a Solana-native DEX aggregator, plays a pivotal role in this surge, accounting for nearly 70% of Solana’s DEX volume, and is praised for optimizing slippage and providing real-time pricing data.

Ethereum’s Ongoing Dominance in High-Value Transactions

Despite Solana’s growing share in DEX trading, Ethereum continues to dominate in higher-value transactions. Ethereum continues to top the tokenization of real-world assets at 82% of more than $5 billion in tokenized assets across blockchains. Last but not least, Ethereum’s liquidity pool is far outpacing Solana’s, while layer 2 solutions and other protocols on Ethereum provide a much greater level of support for large trades and institutional investors.

Ethereum remains the leader in high-value transactions. Source: Dune

“While Solana excels in retail trading with low-cost, fast transactions, Ethereum’s ecosystem is still the preferred choice for high-value transactions,” OKX noted. Ethereum’s market also is highly driven by “whales” or large traders, which help the network’s dominance for volume per address and trade size.

Challenges and Sustainability of Solana’s Growth

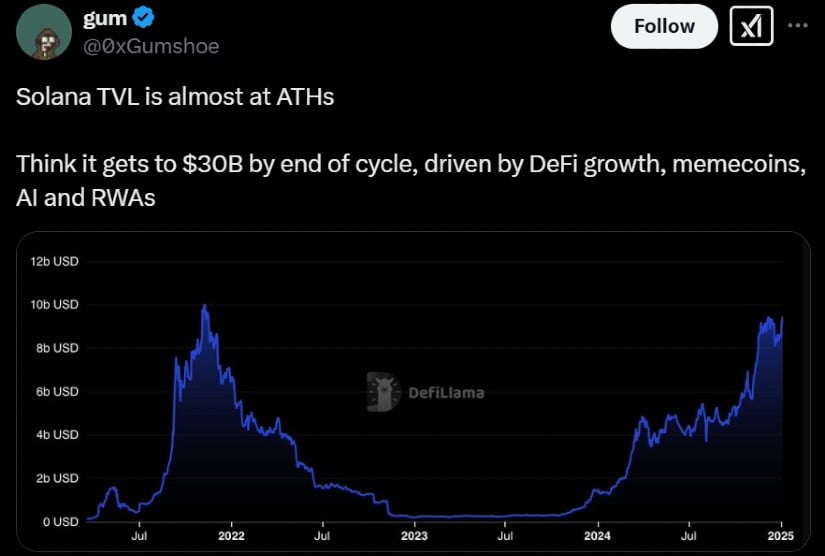

While Solana’s surge in DEX market share is impressive, its lower total value locked (TVL) compared to Ethereum raises questions about the sustainability of its growth. The low-cost, high-speed model of Solana drew the attention of retail traders, as OKX’s report depicted, but liquidity remained smaller and the longevity of market share highly uncertain.

Solana TVL is on a rising trend despite questions on growth sustainability. Source: Gum via X

As Solana attracts more and more users, its ability to continue to sustain these high transaction volumes will come down to scaling its infrastructure to make it even more liquid. The next few months will probably prove crucial in whether the recent success of Solana is here to stay or was just a short-term anomaly.

Solana’s Price and Market Outlook

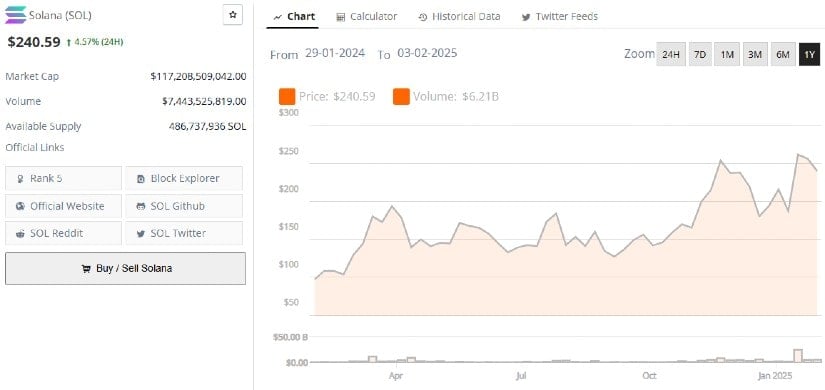

Solana’s market activity is also reflected in its price performance. After a three-day losing streak in January 2025, Solana’s price rebounded by 4.5%, stabilizing around $240. This recovery has spurred a surge in leveraged long positions, signaling growing confidence in Solana’s potential for continued growth.

Solana (SOL ($218.04)) price chart. Source:Brave New Coin

Looking ahead, Solana is positioned for further potential upside. With increased leverage in the derivatives market and a growing retail presence, the network’s price could experience a continued rebound, especially if its market share in DEXs remains strong.

Conclusion: Solana’s Resilience and Future in DeFi

Solana’s rise in the DEX market, marked by its growing market share and rapid transaction speeds, signals a strong future for the network. However, its sustainability in comparison to Ethereum will depend on its ability to attract more liquidity and maintain developer support. Whether Solana can continue to “drink the Ethereum milkshake” and challenge Ethereum’s long-established dominance will unfold in the coming months, but its rise in the DEX space is undeniable.