Nasdaq Futures Slide as Cost-Effective Chinese AI Sparks Investor Anxiety

Nasdaq futures plunged 3%, and U.S. tech stocks experienced a significant downturn as traders reassessed the future of Silicon Valley’s AI leadership.

Chip stocks tumble as DeepSeek shakes markets, with a $1T wipeout looming. Source: The Kobeissi Letter via X

DeepSeek’s latest breakthrough involves AI models capable of running on less advanced chips, challenging the high-cost infrastructure favored by established players like Nvidia and OpenAI. “DeepSeek demonstrates that powerful AI solutions can be developed at a fraction of the cost,” said Vey-Sern Ling, managing director at Union Bancaire Privée. “This could derail the investment case for the entire AI supply chain.”

U.S. and European Markets React

The market turbulence extended beyond the U.S., with Europe’s tech sector also under pressure. Shares of ASML Holding NV, a leading chip equipment manufacturer, dropped over 8%, while futures on the Cboe Volatility Index surged as uncertainty loomed.

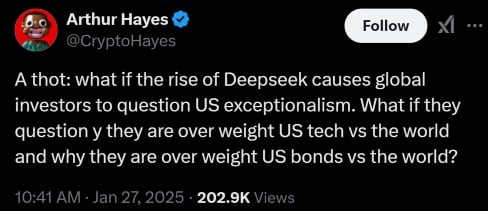

DeepSeek’s rise prompts investors to question U.S. tech dominance and their global portfolio strategies. Source: Arthur Hayes via X

U.S. chipmakers faced sharp losses, with Nvidia shares sliding 5.3% in early trading and other major players, including AMD and Intel, posting declines between 2% and 7%. The downturn reflects mounting concerns over whether American tech firms can maintain their competitive edge as Chinese innovation accelerates.

A Breakthrough in AI Accessibility

DeepSeek, founded by Liang Wenfeng, has quickly gained traction for its innovative approach to AI. Its latest model rivals offerings from OpenAI and Meta but was developed for just $6 million—a stark contrast to the hundreds of millions spent by Silicon Valley giants. The model uses open-source technology and requires fewer chips, making it significantly more cost-effective.

DeepSeek R1 stuns the world just 5 days after launch. Source: Poonam Soni via X

The app associated with DeepSeek’s AI has already topped Apple’s App Store rankings, with users praising its ability to display reasoning and transparency in responding to prompts. Marc Andreessen, a prominent investor, described it as “one of the most impressive breakthroughs in recent AI history.”

This disruptive innovation has cast doubt on the prevailing notion that cutting-edge AI requires massive infrastructure. Nirgunan Tiruchelvam of Aletheia Capital noted, “It challenges the thesis that high capital expenditure is the best path forward for AI dominance.”

Ripple Effects in the Cryptocurrency Market

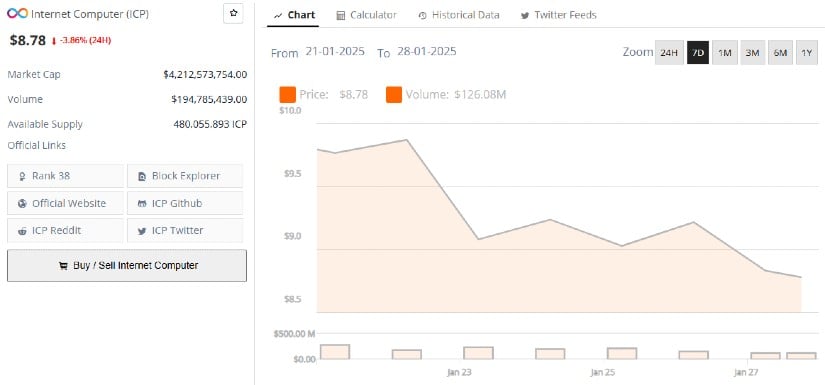

The shockwaves extended to cryptocurrency markets, particularly AI-linked coins such as NEAR ($4.56), Internet Computer (ICP ($8.94)), Render (RENDER), and Filecoin (FIL ($4.65)). These tokens saw declines of 8-10% as investors grappled with the implications of DeepSeek’s low-cost model. The total market capitalization of AI-related coins fell 7.66% to under $44 billion.

The Internet Computer (ICP) token was priced at $8.78, down 3.86% in the last 24 hours as of press time. Source: Brave New Coin

However, some analysts viewed the correction as a potential opportunity. “DeepSeek’s affordability could enable broader adoption of AI, ultimately benefiting the industry,” said a decentralized finance market analyst.

A Wake-Up Call for U.S. Tech

The emergence of DeepSeek underscores the growing competition in AI innovation, particularly between the U.S. and China. Washington’s restrictions on exporting advanced chips to China were expected to hinder its AI development, but DeepSeek’s success demonstrates how open-source tools and ingenuity can overcome such barriers.

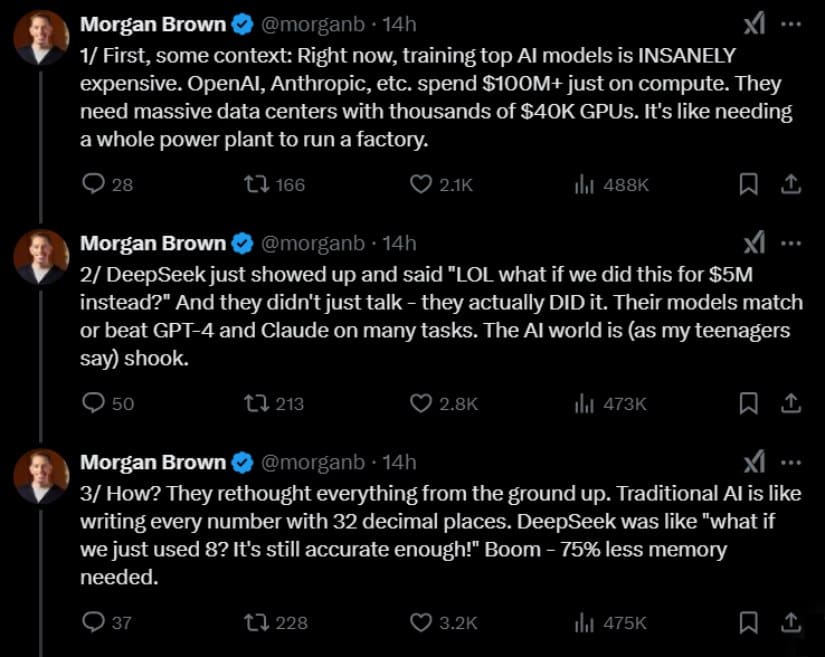

DeepSeek’s R1 AI innovations are shaking up the market and challenging Nvidia’s $2T valuation. Source: Morgan Brown via X

“While current leaders like Nvidia maintain a strong foothold, this is a reminder that technological dominance is never guaranteed,” said Charu Chanana, chief investment strategist at Saxo Markets. “The pace of competition is accelerating, and U.S. firms must adapt quickly.”

DeepSeek’s models have performed strongly on benchmarks like AIME and GPQA, narrowing the gap with U.S. AI leaders. While OpenAI’s ChatGPT remains ahead in coding applications, the margin is rapidly closing, raising questions about the sustainability of Silicon Valley’s current strategies.

Looking Forward

DeepSeek’s AI means a paradigm change in the technological world. By proving that one can get quality AI at a fraction of the conventional cost, it has opened up the AI ecosystem to be more approachable and competitive.

Industry insiders are now watching closely as major U.S. tech firms, including Apple and Microsoft, prepare to release their earnings this week. With the Nasdaq 100 trading at 27 times estimated forward earnings—well above its three-year average—investors are questioning whether current valuations are justified in light of DeepSeek’s disruptive potential.

As the global AI race heats up, DeepSeek’s achievements are a wake-up call for the industry, highlighting the need for adaptability and innovation in an increasingly competitive environment. Whether Silicon Valley can rise to the challenge remains to be seen, but one thing is clear: the era of unchecked U.S. dominance in AI is over.