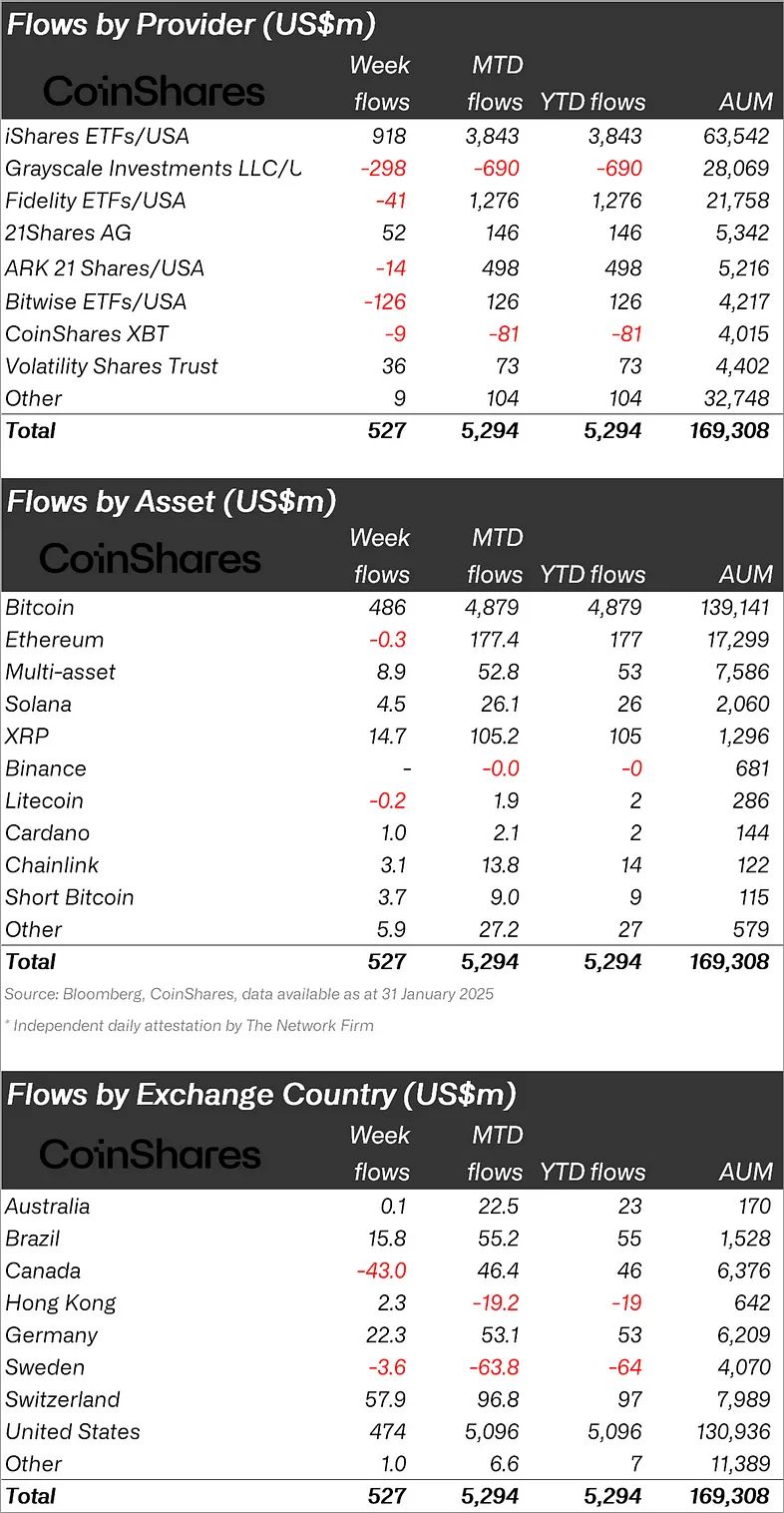

While Bitcoin (BTC ($95,576.92)) and altcoins started the new week with a sharp decline due to Donald Trump’s new customs duties, Coinshares published its weekly cryptocurrency report and said that there was an inflow of $527 million last week.

“Cryptocurrency investment products saw total inflows of $527 million last week. However, intraweek flows reflected volatile investor sentiment, heavily influenced by broader market concerns like the DeepSeek news.”

Entries Have Decreased!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While BTC experienced an inflow of $486 million, Ethereum (ETH ($2,628.24)) experienced a small outflow of $0.3 million.

When we look at other altcoins, XRP ($2.42) saw an inflow of $14.7 million, Chainlink (LINK ($19.27)) $3.1 million, and Solana (SOL ($199.26)) $4.5 million.

“Bitcoin saw a total inflow of $486 million last week and short Bitcoin saw a total inflow of $3.7 million for the second week.

Ethereum ended the week with net zero flows but struggled earlier in the week, likely due to greater exposure to the tech sector and the global growth outlook.

XRP is currently the 2nd best performing altcoin and has seen $105 million in YTD inflows with around $15 million in the past week.

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 474 million dollars.

After the US, Switzerland and Germany also experienced inflows of $57.9 million and $22.3 million respectively.

Against these inflows, Canada and Sweden saw smaller outflows of $43 million and $3.6 million, respectively.

*This is not investment advice.

Continue Reading: CoinShares Released Its New Report: What’s the Latest Situation in Bitcoin and Altcoin Funds? “This Altcoin Is Getting Ready to Settle at the Top!”