The post Cardano (ADA) Sees Record 58% Intraday Reversal, Key Levels to Watch appeared first on Coinpedia Fintech News

Amid the cryptocurrency market’s recovery, ADA, the native token of the Cardano blockchain, has significantly rebounded and is poised for substantial upside momentum. The potential reasoning behind this bullish outlook includes its record 58% intraday price reversal and growing interest from whales, long-term holders, and investors.

ADA Technical Analysis and Upcoming Level

According to expert technical analysis, ADA has experienced a significant price reversal, returning to its bullish range and trading above the crucial support level of $0.71. Additionally, it has successfully retested its 200 Exponential Moving Average (EMA) on the daily timeframe, making the altcoin more favorable for a potential bull run.

Source: Trading View

Source: Trading ViewBased on recent price action and historical momentum, ADA may face mild resistance near $0.85. If it successfully breaches this level and closes a daily candle above $0.86, there is a strong possibility it could soar by 45% and reclaim its recent high of $1.25.

Additionally, ADA has formed a bullish hammer candlestick pattern that supports this positive outlook and signals a potential upcoming rally.

$82 Million Worth ADA Outflow

Amid this bullish outlook, whales and long-term holders have continued their accumulation, which began in the past 24 hours when ADA experienced a sharp decline.

A major on-chain analytics firm, Coinglass, revealed that exchanges have witnessed an outflow of $82 million worth of XRP tokens in the past 48 hours. This substantial outflow amid the ongoing price recovery suggests potential accumulation, which could drive buying pressure and further upside momentum.

Source: Coinglass

Source: CoinglassTraders’ Strong Bet on Long Position

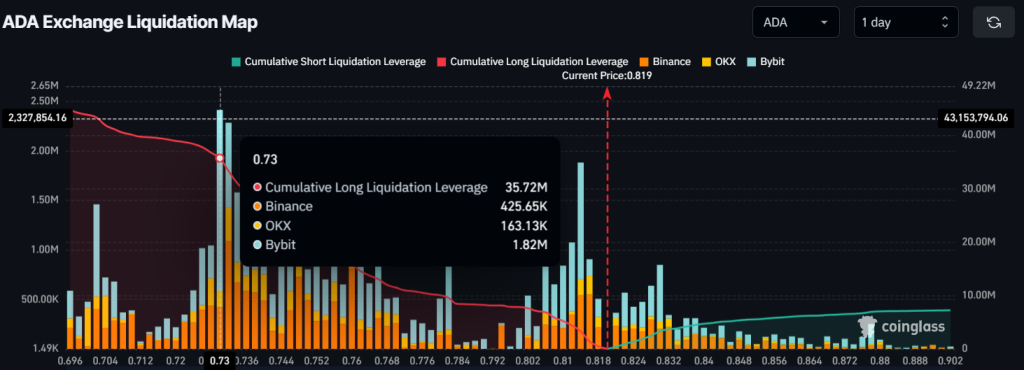

In addition to long-term holders, traders are also found to be over-leveraged on the long side, as revealed by Coinglass data.

At press time, the $0.73 level is the over-leveraged zone, where traders hold $35 million worth of long positions, acting as strong support for ADA. Conversely, $0.83 is another over-leveraged level on the short side, where short sellers hold only $3.32 million worth of short positions, ten times lower than the bulls’ long holdings.

Source: Coinglass

Source: CoinglassWhen combining all these on-chain metrics with technical analysis, it appears that bulls are back in the market and are supporting the altcoin for significant upside momentum.