ETH ($2,815.71)” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-200×114.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-300×171.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-400×229.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-600×343.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-768×439.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-800×457.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1024×585.jpg 1024w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1200×686.jpg 1200w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1536×878.jpg 1536w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92.jpg 1792w” sizes=” 300px) 100vw, 300px”>

ETH ($2,815.71)” decoding=”async” srcset=”https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-200×114.jpg 200w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-300×171.jpg 300w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-400×229.jpg 400w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-600×343.jpg 600w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-768×439.jpg 768w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-800×457.jpg 800w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1024×585.jpg 1024w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1200×686.jpg 1200w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92-1536×878.jpg 1536w, https://bravenewcoin.com/wp-content/uploads/2025/02/805d6ec2-6518-4324-b3b6-2ccbc085ca92.jpg 1792w” sizes=” 300px) 100vw, 300px”>The latest rally was a dramatic rebound from a sharp drop over the weekend. Ethereum began clawing its way back on Sunday night before exploding over 20% by Monday afternoon, erasing its recent losses. While crypto markets are notoriously unpredictable, part of the momentum appeared to come from an unexpected source—Eric Trump.

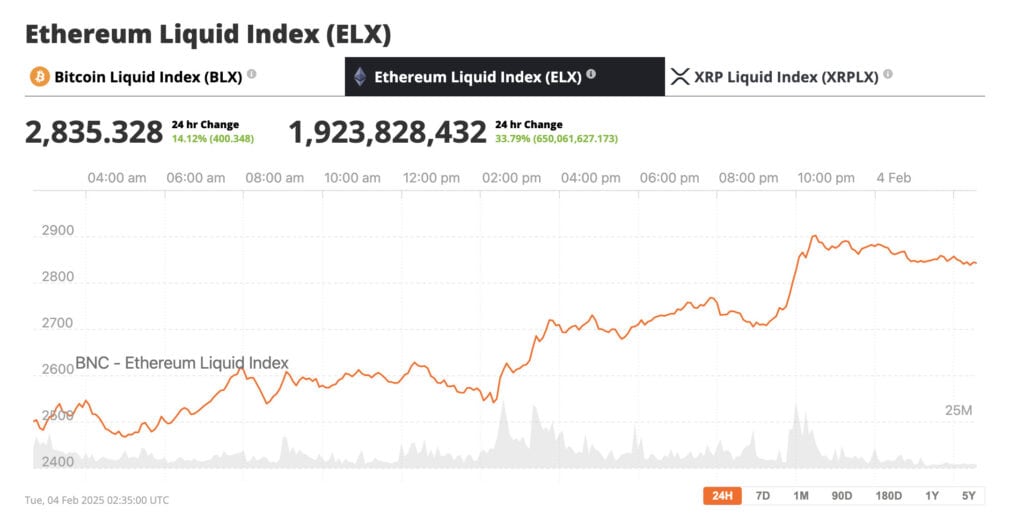

Eth, like all crypto assets, has bounced following the Trump Tariff Dump, Source: BNC ELX

In a tweet on X, former President Donald Trump’s son declared, “In my opinion, it’s a great time to add $ETH.” The phrasing was vague—was this a personal investment tip, or was he hinting at Ethereum playing a larger role in U.S. economic policy?

Eric Trump tweeted “In my opinion, it’s a great time to add $ETH.” Source: X

The Trump Factor

For weeks, rumors have swirled about a potential U.S. strategic Bitcoin reserve, and just this Monday, President Trump signed an executive order to create a sovereign wealth fund. Yet, Ethereum appears to be on the sidelines of these developments—at least officially.

However, the Trump family does have skin in the Ethereum game. Their latest venture, World Liberty Financial, is a DeFi project backed by the former president himself. World Liberty’s treasury is heavily stacked with Ethereum, suggesting a financial interest in Ethereum’s success that goes beyond casual crypto advocacy.

Blockchain analysts on X have pointed out that World Liberty has been accumulating Ethereum for some time, in fact the team bought more during yesterday’s Trump Tariff Dip.

WLF bought more ETH, Source: X

Ethereum’s Crossroads: Internal Chaos and Market Shifts

This rally comes at a critical juncture for Ethereum. While the entire crypto market has seen a recent surge, Ethereum’s market cap has not kept pace with competitors like Bitcoin, XRP ($2.73), and Solana. More troublingly, tensions are brewing within the Ethereum developer community, with factions arguing over the blockchain’s governance, leadership vacuum, and sluggish innovation.

Despite its reputation as the world’s most versatile blockchain—thanks to its smart contract functionality—Ethereum’s dominance is no longer unquestioned. Critics argue that high fees and slow transaction speeds have allowed rival chains to eat into its market share.

Ethereum is the brainchild of Vitalik Buterin, the visionary programmer who first outlined its concept in a 2013 white paper. The network officially launched in 2015, revolutionizing crypto by introducing decentralized applications. But today, nearly a decade later, Ethereum is at a crossroads—caught between its past innovations and the pressure to evolve faster, while new chains such as Solana eat its lunch.

For now, at least, traders seem to have bought into the Ethereum comeback story. And from an unlikely source, the Trumps. The comeback could continue, tomorrow Crypto and AI Czar David Sacks will. give a press conference where he will explain how digital assets are a key part of the American future. Is Eric Trump trying to tell us that ETH will play a part? Will ETH be part of Trump’s Sovereign Wealth Fund? We’ll know more tomorrow.